Depreciation expense formula

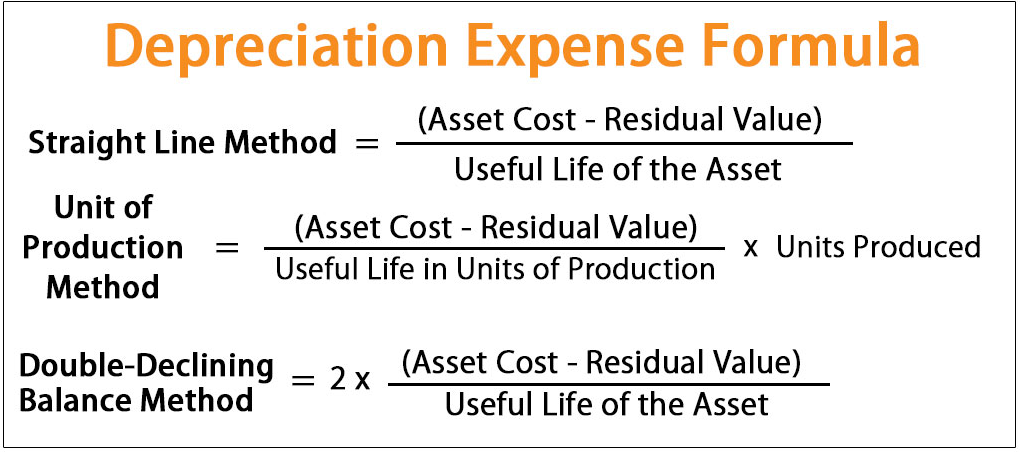

The Depreciation Schedule is used to track the accumulated loss and remaining value of a fixed asset based on its useful life assumption. The formula is as followed.

Depreciation Formula Calculate Depreciation Expense

Depreciation Expense Beginning Book Value for Year 2 Useful Life.

. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. This method uses the following formula. In year one you multiply the cost or beginning book value by 50.

The method takes an equal depreciation expense each year over the useful life of the asset. You buy a car for 50000. The formula is as followed.

The units-of-production depreciation method calculates the depreciation expense per unit or product. This amount is then charged to expense. Step one - Calculate the depreciation charge by using below given formula.

The double declining balance depreciation method is one of two common methods a business uses to account for the. The straight line calculation steps are. It has a useful.

Determine the cost of the asset. The DDB rate of depreciation is twice the straight-line method. Then later on in the assets life the depreciation expense starts to fall slowly.

Periodic Depreciation Expense Fair Value Residual Value Useful life of Asset. Calculating Depreciation Using the Units of Production Method. You then find the year-one.

Businesses depreciate long-term assets for both tax and accounting. Depreciation is a non-cash expense that reduces the. Depreciation expense is that portion of a fixed asset that has been considered consumed in the current period.

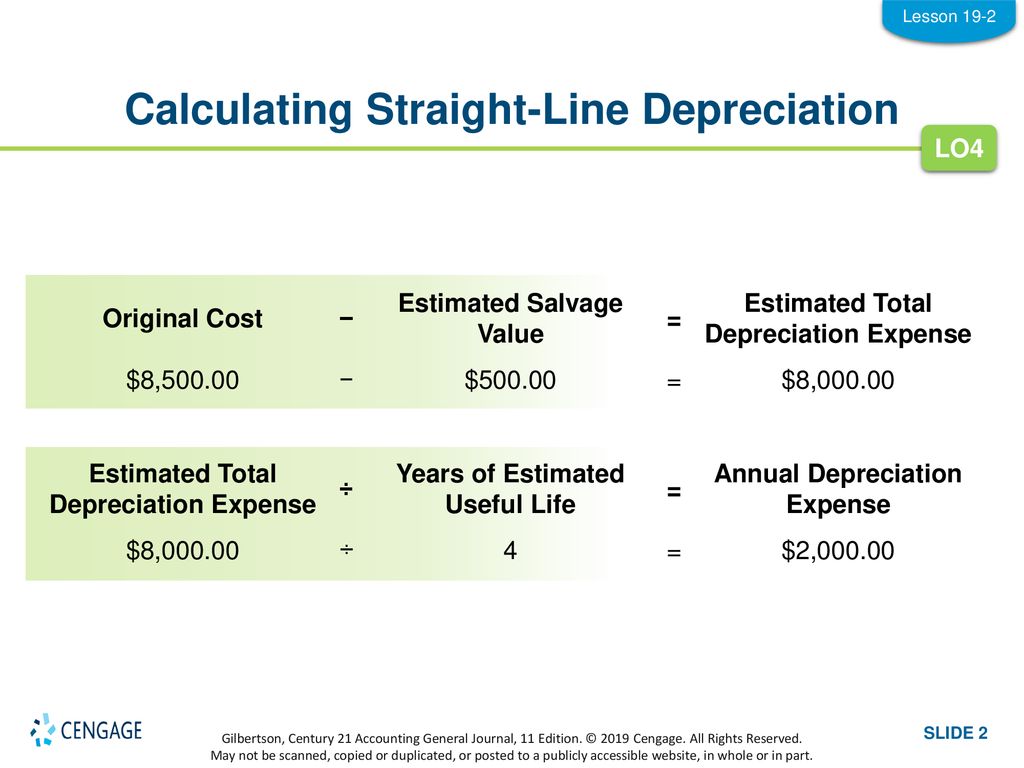

Sep 14 2021 4 min read. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable. Fixed assets lose value over time.

Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life. This method results in depreciation expenses being higher earlier in the assets life. How to Calculate Depreciation Expense.

The straight-line method of depreciation allocates its cost over its useful life. Lets use a car for an example. The intent of this.

Under this method the calculation of depreciation is based on the fixed percentage of its cost. Depreciation Formula Calculate Depreciation Expense The formulas. Asset cost - salvage valueestimated units over assets life x actual units made.

Unit depreciation expense fair. Double Declining Balance Depreciation Method.

Accumulated Depreciation Definition Formula Calculation

Depreciation Formula Examples With Excel Template

Depreciation Methods Principlesofaccounting Com

Depreciation Expense Double Entry Bookkeeping

How To Calculate Depreciation

How To Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Unit Of Production Depreciation Method Formula Examples

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

Lesson 19 2 Calculating Depreciation Expense Ppt Download

Depreciation Expense Calculator Hot Sale 57 Off Www Ingeniovirtual Com

Depreciation Calculation

Depreciation Expense Calculator Hot Sale 57 Off Www Ingeniovirtual Com

Straight Line Depreciation Formula And Calculation Excel Template

Annual Depreciation Of A New Car Find The Future Value Youtube